- Newsroom

- Published on:

How partnerships are moving Europe’s vehicle manufacturers into the fast lane

- MHP mobility study 2025 confirms: strategic partnerships are critical to the success of the automotive industry in Europe, China, and the USA

- European automotive industry: OEMs and suppliers in particular need close cooperation partnerships to successfully master the transformation process

- Main drivers: companies are striving for technology transfer, innovations, and new markets

- Local for local: regional partnerships are becoming more important in the light of tariffs and geopolitical tension

Study: The Power of Partnerships

Ludwigsburg – Partnerships are becoming the key success factor in the automotive transformation process. Already today, 52% of companies in the European automotive industry rate old and new partnerships as “important” or “absolutely important” to their future viability. This conviction is even more firmly held in China (57%) and the USA (73%). What’s more, most OEMs and Tier 1 suppliers expect the relevance of partnerships to grow by more than 25% over the next three years. US manufacturers lead the way here with 76% of respondents holding this opinion, closely followed by China with 69%. In the EU5 countries, 53% of respondents see a clear increase in importance.

These figures from the MHP mobility study “The power of partnerships” support the assertion that strategic cooperations are becoming the key factor in the transformation of the automotive industry, while also highlighting the differences between the regions. The study is based on a survey of 650 managers from the EU5 countries (Germany, the UK, Spain, France, and Italy), China, and the USA. Decision-makers from OEMs were surveyed, along with Tier 1 and Tier 2 suppliers, technology partners, and service providers.

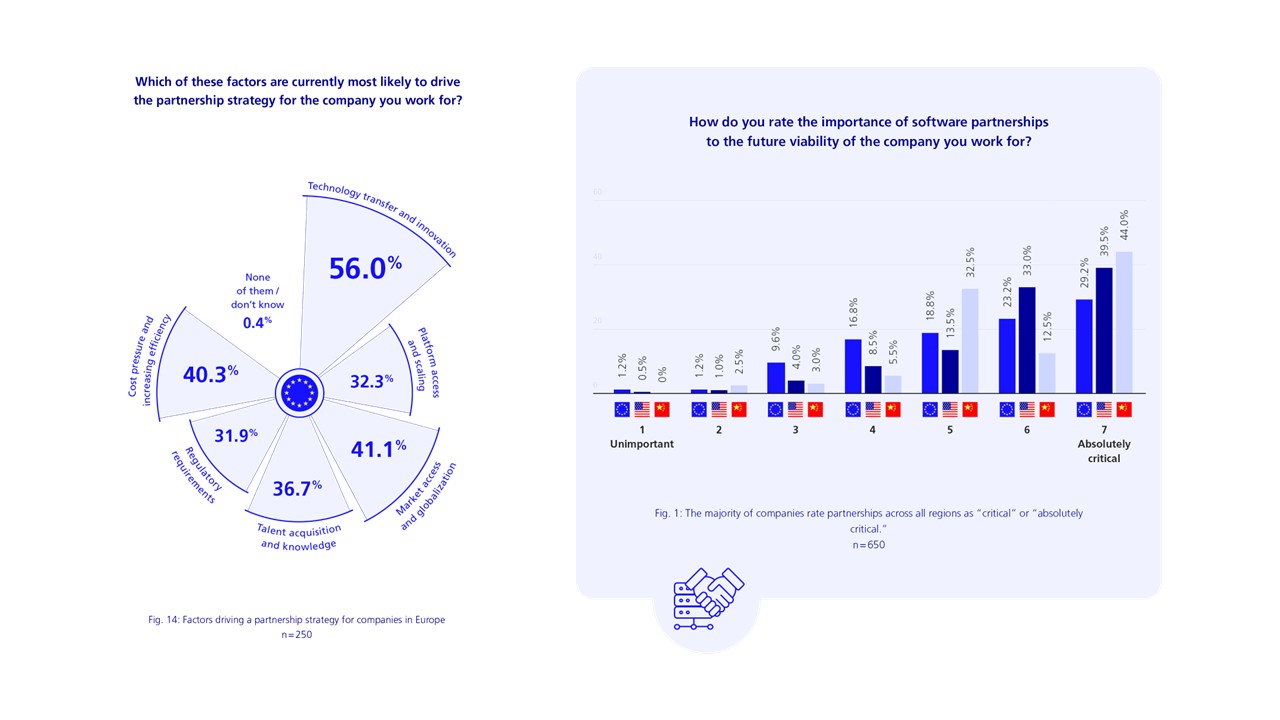

Technology transfer as a common goal, but country-specific focus areas

The main motive for new partnerships was identical across the three regions. Technology transfer and innovation top the list in the EU5 countries with 56%, as well as in China (55%), with a particularly strong showing of 72% in the USA. In addition, European companies also hope to gain access to new markets (41%) and reduce cost pressure (40%).

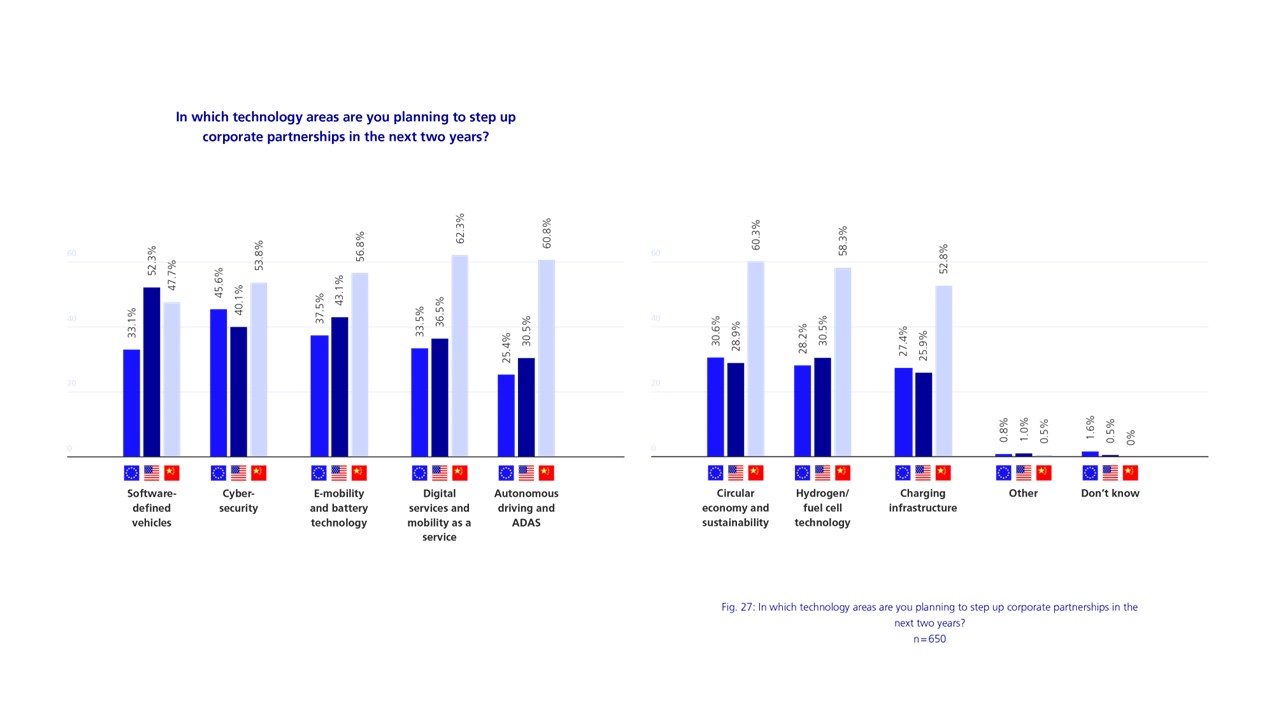

There are clear differences when it comes to the technological focus areas of strategic partnerships. A majority of 52% of the European companies surveyed are currently cooperating on cybersecurity, while 59% of US companies are trying to work on software-defined vehicles, and 54% of Chinese companies are embracing e-mobility and battery technology partnerships.

“The figures clearly show that the USA is using partnerships the most as a driver of innovation, while Europe remains too fixated on optimizing costs and minimizing risk. European manufacturers need to be bolder and use partnerships more to support technological leaps,” said Augustin Friedel, Associated Partner at MHP and a specialist in software-defined vehicles.

The three main drivers of the current transformation – electrification, software-defined vehicles, and artificial intelligence – form the technological core that is challenging the industry worldwide and at the same time compelling companies to forge new alliances. It is precisely in these fields that investment and development costs are rising massively, which means that cooperation is increasingly becoming a competitive factor.

The study also reveals that “local for local” is no longer a peripheral matter, but is evolving into an important trend in the global automotive industry. In the light of rising tariffs and geopolitical tensions, Chinese and US manufacturers in particular are opting for local partnerships in the target markets to cut costs and minimize political risks.

Based on the international survey, current market analyses, and case studies, the study attests to the fact that companies will only be able to grow in the future by embracing strategic cooperation. The main reason for this is the profound transformation of the automotive industry, with electrification, software-defined vehicles, artificial intelligence, and autonomous driving all raising the level of technical complexity and increasing the investment and development costs. At the same time, new competitors from Asia and the USA are surging onto the market with innovative solutions that are putting traditional vehicle manufacturers under pressure.

“For decades, corporate success in the automotive industry has been defined by competitive advantage. Those who possessed superior technologies or established more efficient processes were considered the winners. In the digital age, however, this lone wolf logic reaches its limits. AI, cloud-based platforms, and networked ecosystems are fundamentally shifting the success factors. New networks of specialized partners are working together to drive innovation – and generate a collaborative advantage that is vital for remaining competitive,” said Dr. Jan Wehinger, Partner at MHP.

Facts, figures, and recommended courses of action for decision-makers

Despite numerous cooperation announcements, it will only become clear in the coming years which alliances will last. That’s because the challenge lies not only in the strategy, but above all in the implementation: “Only those who manage to link their own corporate strategy with the right partners and a clear operational implementation logic will survive in the competition,” stressed Augustin Friedel.

The MHP mobility study 2025 also provides recommended courses of action for decision-makers. It shows that partnerships are only successful in the long term when clear added value is created for all parties. It is equally important to overcome cultural barriers, with shared values and open communication considered the key to long-term success. Active risk management is also essential – from valid due diligence to clear intellectual property rules and fair revenue sharing models.

About the MHP mobility study 2025

As understood in the context of the study, partnerships differ from traditional supplier–customer relationships in terms of their strategic aspect. The criteria include a collective vision, the joint development of new technologies, and shared risks and opportunities. The study focused on partnerships involving car IT, enterprise IT, and platforms.

In July 2025, MHP commissioned an online survey of 650 private-sector decision-makers in the automotive industry for the international study. The managers across all hierarchical levels come from the EU5 countries (Germany, the UK, Spain, France, and Italy), China, and the USA. While technology partners and service providers dominate in Europe and the USA, China shows a more balanced distribution with a strong presence of Tier 1 and Tier 2 suppliers.

Partnerships are becoming a decisive factor for success in the automotive transformation: Already today, 52 percent of companies in the European automotive industry rate old and new partnerships as “important” or “absolutely important” for their future viability. (Photo: Adobe Stock)

In which areas of technology do you plan to intensify corporate partnerships over the next two years? (Graphic: MHP)

OEMs and suppliers from Europe see technology transfer and innovation as key factors for partnerships. The majority of companies across all regions rate partnerships as critical or absolutely critical. (Graphic: MHP)

Augustin Friedel, Associated Partner at MHP. (photo: Marco Lombardi)

Dr. Jan Wehinger, Partner at MHP (photo: MHP)

MHP Newsroom

Need information about MHP or our services and expertise? We are happy to help and will gladly provide you with current information, background reports, and images.